The impact of human behaviour on our planet and environment is now well documented. We are at a critical point where consumers need to make a behavioral change. In Britain, the WWF reports that 75% of consumers agree that if we don’t change the way we live in the next 10 years, the state of the planet will put the survival of future generations in jeopardy. But do consumers make sustainable choices when it comes to their smartphones?

Smartphone manufacturers are increasingly putting sustainability at the core of their business, believing it goes hand-in-hand with future profitability. Both Apple and Samsung made the headlines when they removed charging adapters from their smartphone retail packaging, claiming that the change will reduce carbon emissions. OPPO has also adopted sustainable production processes, spanning from design, packaging, and material processing.

However, it is interesting to note that consumers aren’t rushing to embrace the newer, sustainably led brands just yet. Fairphone is the first smartphone company to integrate Fairtrade gold into its supply chain, yet Kantar’s Worldpanel ComTech shows them to have <1% installed base share across the EU5 (France, Germany, Great Britain, Italy and Spain) and US markets. Kantar will be tracking the key consumer trends, adoption of sustainable brands over time and the impact of sustainability strategies from the big global brands.

Smartphone lifecycles

Consumers often must balance cost and convenience when managing their environmental impact. In the smartphone market, simply keeping your current device for longer saves money and positively impacts the planet – and we know that consumers are holding onto their smartphones for longer. In March 2021 across the EU5, the length of time consumers hold onto their devices has increased +2.8 months compared to March 2019. In the United States this has jumped +2.4 months.

Sustainable legislation

Wider macro trends are also at play, in Europe a ‘right to repair’ bill is being introduced this summer. The bill will legally oblige manufacturers to make spare parts for products available to consumers for the first time, increasing the ease to repair a broken phone. Across the EU5 markets, 1 in 2 consumers purchased a new smartphone because their previous device broke (12 months to March 2021), and it will be interesting to monitor how this evolves in the coming months following the introduction of the bill.

These market developments pose a challenge for smartphone manufacturers, network providers and retailers, who are turning to sustainable practices to drive sales. But what exactly are these levers and do consumers care?

Trade-in

One such lever is the ability to trade in your old device, at the time of purchasing a new handset, and this is an increasingly popular mechanic used to drive sales, notably amongst US consumers with 1 in 5 trading in their previous device, versus 5% of EU5 consumers (12 months sales March 2021). Whilst trade-ins are not a new concept, manufacturers, network operators/carriers and retailers are beginning to promote the environmental benefit of these schemes. Understanding the audience and behaviors of those that trade in is increasingly important in driving sales and encouraging the behavior across the wider population. In the US, Millennials are more inclined to trade in their previous device with an increasing proportion turning to network providers to conduct their purchase – notably AT&T.

Refurbished phones

Refurbished devices are also increasing in popularity, promising to provide consumers a lower cost handset with a positive environmental impact. The EU5 refurbished space is currently valued at €1.5bn and offers great potential growth. These are particularly popular in France, where 9% of consumers purchased a refurbished device (12 months sales March 2021). Across the EU5, Apple dominates the refurbished market accounting for 6 in 10 refurbished devices sold.

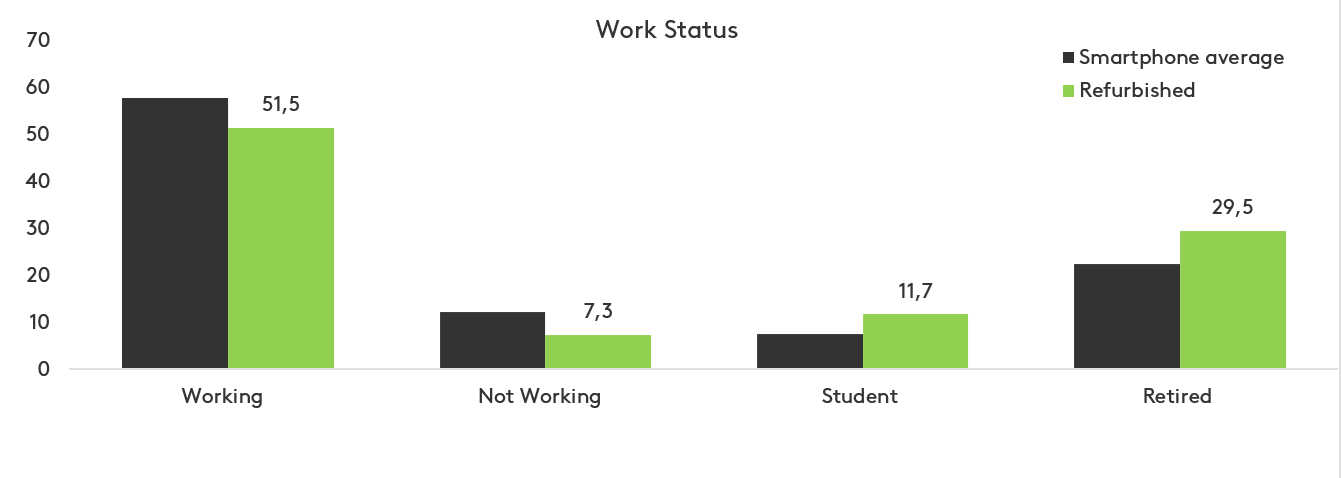

Refurbished buyers are split between Gen Z and older consumers, with an over-index across students and retirees.

Interestingly, refurbished consumers are more likely to have purchased as they ‘wanted a newer phone’, suggesting that correctly positioning refurbished can generate an uptick in demand across the wider Smartphone category.

Consumers will increasingly expect brands to lead the way in improving sustainability. For many, a smartphone is viewed as an extension of themselves, from the logo on the back to the case that it’s wrapped in. In the future, these devices will also reflect our environmental stance.

Somewhat ironically, mechanics that reduce the cost and inconvenience of a purchase are often positive for the environment – for example buying a refurbished phone is cheaper and greener than buying new. Manufacturers, network providers and retailers will increasingly look to new ways of promoting sustainability whilst driving sales – we expect to see significant developments in this space in the coming years.