Grocery price inflation has climbed again to reach 17.5% over the four weeks to 19 March 2023, a new record based on our latest market data. Households are now facing an £837 increase in their annual shopping bills if they don’t change their shopping behaviours. Take-home grocery sales more widely grew by 8.6% over the 12-week period.

Unfortunately, it’s more bad news for the British public, who are experiencing the ninth month of double-digit grocery price inflation. However, shoppers are taking action and clearly hunting around for the best value. Footfall was up in every single grocer this month, with households going to the shops just over four times per week in March. Apart from Christmas, that’s the highest frequency we’ve seen since the start of the pandemic.

The supermarkets are also tackling grocery price inflation, battling it out to demonstrate value and get customers through their doors. This is a fiercely competitive sector and if people don’t like the prices in one store they will go elsewhere, with consumers visiting three or more of the top 10 retailers in any given month on average.

The majority of retailers have used loyalty card schemes as a tactic to attract and retain shoppers. Store cards have emerged as an important way to provide value amid the high cost of living with the grocer offering cheaper prices, coupons and points for people who scan them at the till. Our latest data shows that more than nine in 10 of us have at least one loyalty card in our wallets and usage is on the rise.

Own label taking share but branded sales accelerate

Shoppers are also bringing the cost of their groceries down by picking up more own label lines and sales were up again by 15.8% during the latest four weeks compared with last year. However, people are keeping some space in their baskets for the brands they know and love. Outside the discounters Aldi and Lidl, branded goods still make up 52% of the market and sales grew by 7.2% over the past month, the fastest rate we’ve seen since February 2021. Many brands are innovating and bringing new products to the shelves to maintain their popularity, and 10% of their sales in the last year came from new or updated items.

The availability of fresh fruit and vegetables was high on the agenda at the end of last month, but our latest data shows that shoppers didn’t generally go without. Despite concerns about shortages, the number of baskets containing tomatoes, cucumbers or peppers in the 10 major grocers stayed at 17% in March, the same as February. For any shoppers who couldn’t get what they wanted in larger supermarkets, the independents stepped in, with the volumes of tomatoes, peppers and cucumbers in baskets rising by 32%, 26% and 21% respectively in these stores.

Shoppers have begun looking ahead to Easter as Spring officially arrived in March. Easter Sunday falls slightly earlier this year and chocolate egg sales are already up 6% in volume terms on last year. The ever-popular hot cross bun is also making its way into shoppers’ baskets again, with sales up by 5%.

Lidl lead the pack and Morrisons return to growth

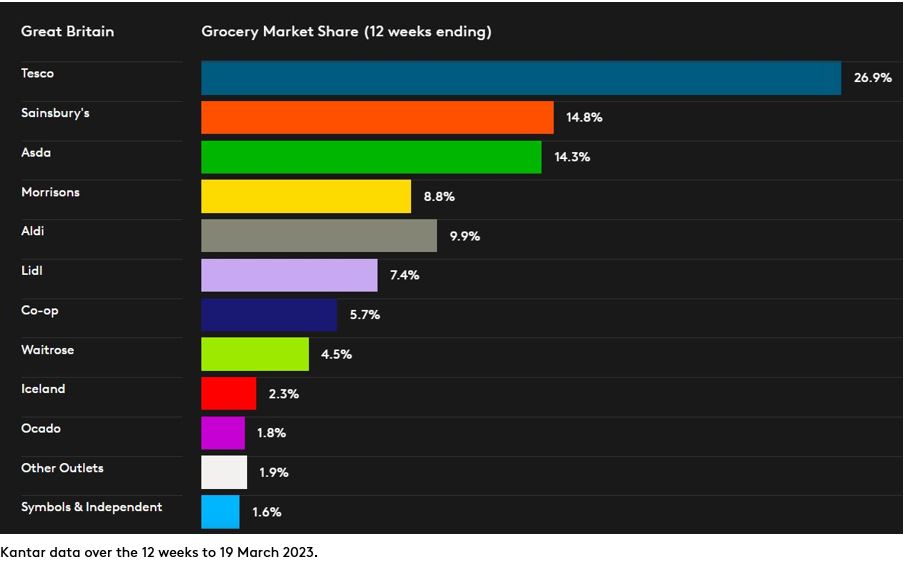

Across the retailers Lidl was the fastest growing supermarket as its sales rose by 25.8%. It achieved a market share of 7.4%. Aldi secured a new record market share this month at 9.9%, driven by a 25.4% increase in its sales.

Morrisons saw a welcome return to growth with sales rising by 0.1%, giving it an 8.8% market share. Waitrose also had a positive period, pushing up sales by 2.1% to deliver the fastest rate of growth for the John Lewis Partnership owned supermarket since September 2021.

Asda’s sales increased by 7.3%, just ahead of both Tesco and Sainsbury’s on 6.9%. Tesco remains Britain’s largest grocer with a 26.9% share of the market, while Sainsbury’s is on 14.8% and Asda 14.3%. Frozen specialist Iceland performed strongly, increasing its market share to 2.3%, up 0.1 percentage point as sales rose by 9.6%. Convenience retailer Co-op now has a 5.7% share and Ocado’s market share remained at 1.8%.