Our latest data shows that take-home grocery sales in Ireland increased by 7.9% in the four weeks to 3 September 2023 as the average price per pack increased by 8.8%. Shoppers visited stores more often this month making one additional trip versus last month. However, they bought on average one item less per month.

Grocery price inflation, which stands at 11.5% in the 12 weeks to 3 September, is the main reason for the increase in value sales, despite it falling to the lowest level since September 2022.

This slowdown in grocery inflation is welcome news for consumers. This is the fourth month in a row that there has been a drop, down 1.3 percentage points compared to last month, which is encouraging for both shoppers and retailers. Although the rate of inflation is still relatively high, it is the lowest level we have seen in the last 12 months, and we expect it to continue to fall over the coming months.

The percentage of packs sold on promotion dropped slightly by 0.6 percentage points compared to the same period last year, while the percentage of sales sold on promotion currently stands at 24.1%.

Sales of own label products were up 11.9% in the latest 12 weeks, more than double the sales growth of brands at 5%. Value own label ranges had the strongest growth, up 17.8%, with shoppers spending an additional €10.3m year-on-year as they look to save money at the tills. Own label value share hit 47.9%, while brands hold a value share of 46.6%.

Back to school and the return of the packed lunch

Regardless of rising costs, parents had to prepare for the end of summer and schools reopening at the start of the month. This is an important time for many consumers with parents stocking up and getting ready for the return of the packed lunch. As a result, shoppers spent an additional €7.4m on biscuits, €1m on breakfast cereals, €2.2m on cheese and €947k on bread.

Online sales were strong over the 12-week period, up a significant 18.5% year-on-year with shoppers spending an additional €27m on the platform, with more frequent trips (+11.3%) and 17.4% of Irish households buying their groceries online. With back-to-school preparations in full swing, young families went online for their groceries, spending an additional €13m compared to last year.

Irish retailer performance update

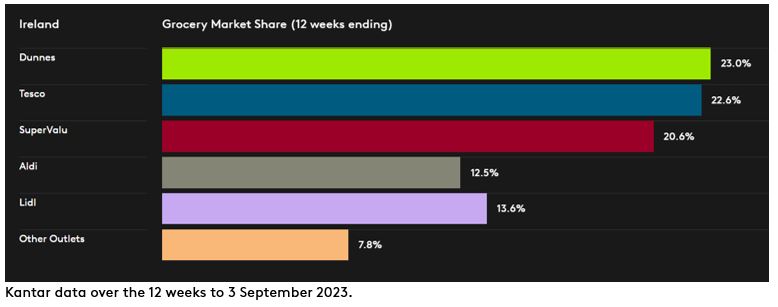

Dunnes, Tesco and Lidl all grew ahead of the total market in terms of value this month.

Dunnes holds 23% of the market with growth of 11.1% year-on-year. Dunnes saw a strong boost in new shoppers, up 3 percentage points year-on-year, which is the strongest boost in new shoppers out of all the retailers.

Tesco holds 22.6% of the market with growth of 11.5% year-on-year. Tesco saw the strongest frequency growth among all retailers once again, up 16.1% year-on-year, which contributed an additional €96.1m to overall performance.

SuperValu holds 20.6% of the market with growth of 4%. SuperValu see shoppers visit their stores most frequently compared to all other retailers, making 21.3 trips on average.

Lidl holds 13.6% share with growth of 11.6% year-on-year. More frequent trips contributed to an additional €37.1m to overall performance. Aldi holds 12.5% with growth of 5.6% year-on-year, with a strong boost in new shoppers and more frequent trips contributing an additional €25.1m to overall performance.