The AppleTV+ streaming service recently hit the headlines as its original series, Ted Lasso, became the most nominated freshman comedy series in Emmy award history. This follows previous Emmy success for the high budget The Morning Show and Ghostwriter series.

However, success in the awards circuit does not always correlate with success in subscriber numbers, or commercial success more broadly.

An expanding library

AppleTV+ made its US debut in November 2019, with an international rollout to markets like Great Britain, Japan and Germany following soon after. Without a substantial back catalogue of content and with only a limited number of high-profile launch series, Apple offered AppleTV+ for free to anyone who bought its hardware – ranging from iPhones to AppleTV+ streaming devices.

Early headlines reflected on the lack of content and this was broadly played out in the data – with those who had had the service a full three months showing a worrying decline in their overall satisfaction with the service content. Since then, Apple has continued to invest heavily in original series, such as For All Man Kind and See, as well as bringing back family favourite Charlie Brown through Snoopy in Space.

While this content investment ploughed on, Apple decided – not once, but twice – to extend its free trial to subscribers. This meant that those who took advantage of the free 12-month trial offer when it was first announced, received an additional nine months of the service for free. This is not a move that inspires confidence. Yet, if you look deeper into the service, it can be seen that many key success metrics are gradually ticking up, reducing the need for seemingly endless free trials. Apple can no doubt afford extensions of free trials, while continuing to invest in content and clearly wanting to be certain that the offering is sufficiently strong to attract paying subscribers.

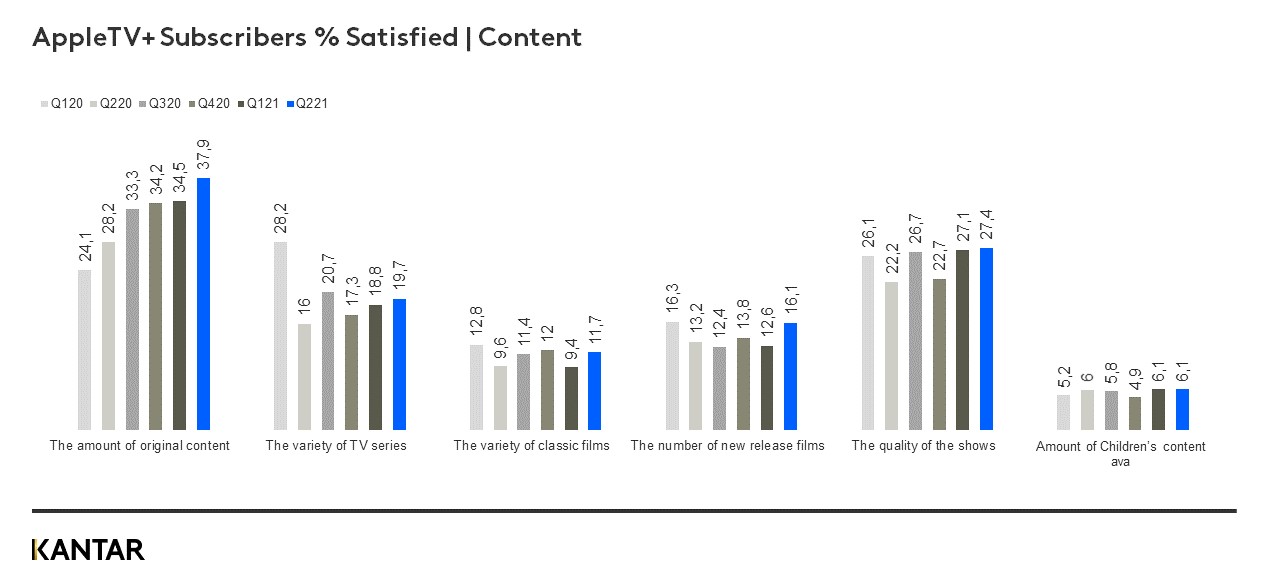

In its first full launch quarter, satisfaction across many metrics tended to be quite high, but that quickly fell as subscribers exhausted the viewing options. However, over time, the key metric that links most strongly to retention is the amount of original content, which continues to rise and has closed the gap to Netflix from 25% at launch in 2019 to 19% in Q2 2021.

Top shows drive binge watching

AppleTV+ subscribers say they regularly binge watch series, more than with any other services – 78% (vs. 61% average). This shows great engagement in the category and tends to generate spikes in demand and then lulls in activity. This can clearly be seen in the usage data.

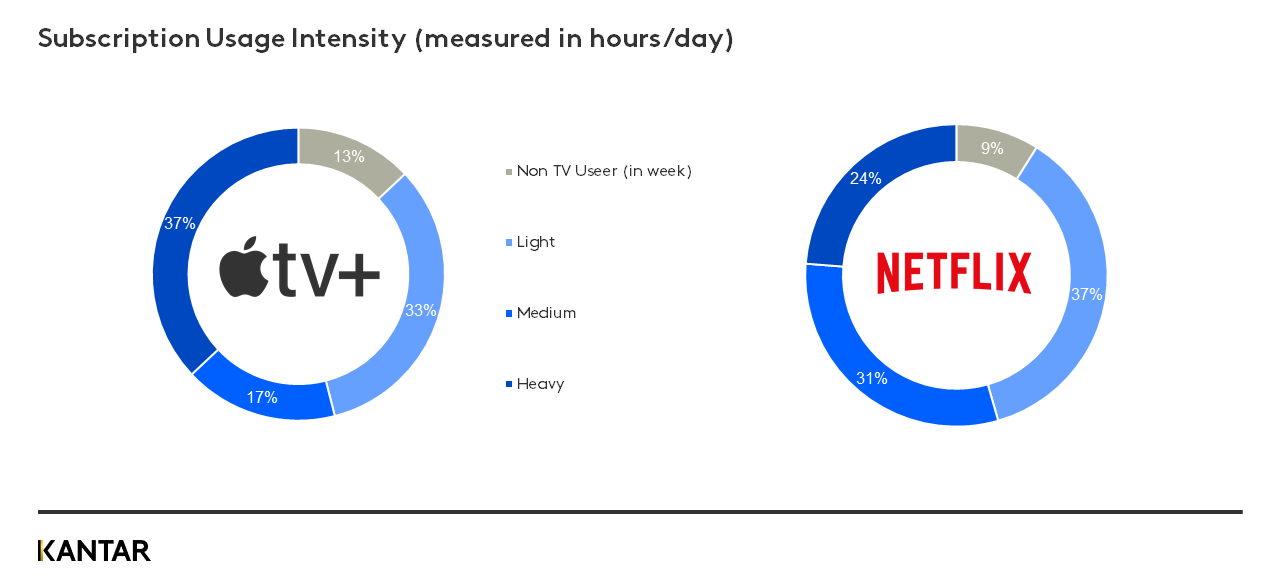

In June, Apple had more heavy users of the service than Netflix, but few medium intensity users – so customers are either binging or not using it much at all. AppleTV+ usage month by month tends to be jumpy, reflecting their reliance on key titles to drive engagement, while Netflix is very steady, with almost no movement overtime.

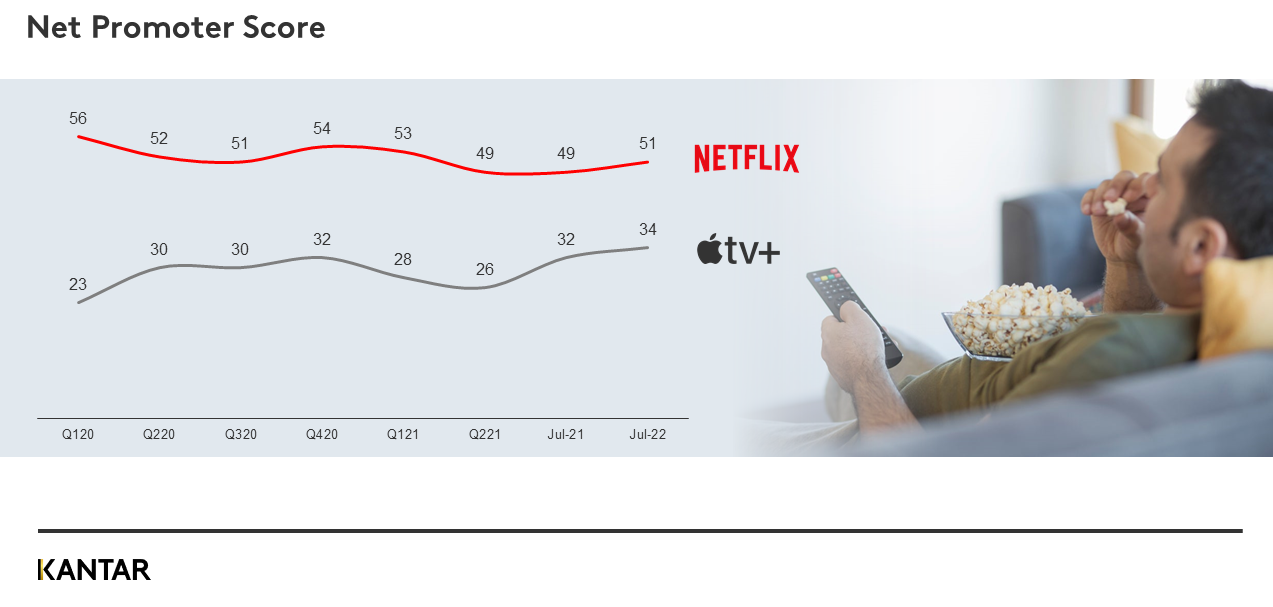

In August 2021, the Net Promoter Score (a measure of subscriber advocacy) for AppleTV+ also hit its highest ever score at +34, almost halving the gap to Netflix (+51 and falling) from launch until present.

Paying subscribers on the rise

As overall ‘satisfaction’ and ‘advocacy’ of the service trend upward and reach competitive levels, there is the point at which AppleTV+ must start to stand alone without the support of free trials.

There are early signs that strengthening the offer is already translating into more paying subscribers. In August, 54% were paying for the service – up from 50% in June. As Apple moves to monetise free triallists, it is also encountering the same account sharing issues as its competitors. The number of AppleTV+ users sharing an account rose to 10% – a 3% increase since June.

While AppleTV+ doesn’t stand out for its kids and family content, in terms of user feedback its subscribers believe that video streaming has a key role to play in educating children. Some 37% of AppleTV+ subscribers either strongly agree or agree that video streaming is an important way for them to educate their children (vs. 21% average). While Disney+ owns this space currently, it shows there is clear potential for Apple to widen its appeal through education – an area which the brand already excels in many other divisions of its business.

AppleTV+ charts a unique path to success

It’s tough to enter a market that is heavily reliant on back catalogue content to attract and retain customers. Undeniably Apple has the financial means to have acquired existing content faster than it has, but it’s stuck to its guns and focussed on making high-quality original content. That takes time, and Apple has taken steps to ensure it keeps its early adopters happy while it becomes more competitive. The true test comes next.

While AppleTV+ has taken big strides, risks remain. Churn is high (12% in August) when benchmarked against the competition, and future intention to cancel is still in double digits. Appetite among non-subscribers is muted, with just 6% considering ‘taking the service’ and 4% ‘intending to’.

The market is also evolving. New entrants are making consumers think even harder about where to spend their money and question if long-term loyalty to platforms is sensible. Apple’s quiet progress in streaming should be applauded. They have deliberately taken the hard road and are making improvements, but the path to Apple’s success is long and there remains much work to do.

Kantar’s Entertainment on Demand service tracks the full digital subscription consumer journey across the Subscription Video on Demand (SVoD) market. Please reach out to our experts if you would like to learn more.

(Source: Kantar, Worldpanel Division, ComTech EoD service Q2 2021 US)